The final 2025 tax reconciliation package (also known as the One Big Beautiful Bill Act – H.R.1) was signed into law on July 4, 2025. This bill passed both chambers by narrow margins. It passed 215-214 in the House of Representatives in May and 51-50 in the Senate on July 1st. The House then ultimately passed the Senate’s version of the bill 218-214.

Congress was motivated to act on a bill tackling tax policy given the looming expiration of some provisions of the Tax Cuts and Jobs Act of 2017 (TCJA). Given this type of bill, budget reconciliation, also can include spending, the legislation also became a vehicle for Trump Administration priorities like funding for immigration, border security and defense.

While there are individual tax policy changes that made it into the final law that may help some families with their child care expenses, there are many federal program changes that are harmful to millions of children and families and we expect to see future challenges for states, communities, families, and child care providers as a result of this law.

What’s Included in the Law for Child Care?

The Child and Dependent Care Tax Credit

- Previously—working parents could claim a part of their child care expenses on their annual taxes and receive a percentage back based on their income starting at 35%—this resulted in a credit back of up to $3,000 for one child and up to $6,000 for two or more children.

- Under the new law—families with the lowest incomes will now receive a maximum credit of 50% of their claimed child care expenses. This will result in nearly 4 million families seeing an increased tax credit.

Find out if the CDCTC changes will impact your family using this calculator.

Employer-Provided Child Care Credit (45F)

- Previously—businesses that want to help locate or provide child care for their employees could receive a maximum tax credit of $150,000 which was based on 25% of their qualified child care expenses.

- Under the new law—the maximum credit and credit rate is increased. The credit is also indexed to inflation. Additionally, it increases the credit rate and maximum credit specifically for small businesses and simplifies processes for multiple employers to jointly contract with a qualified child care provider.

Dependent Care and Assistance Programs (DCAP)

- Previously—families whose employer participated in DCAP, which allows parents to set aside pre-tax income to pay for child care in an employer-offered flexible spending account, could deduct up to $5,000 per year from their pre-tax earnings to pay for dependent care expenses.

- Under the new law—the amount of pre-tax income families can deduct is increased to $7,500 annually.

Military Fee Assistance

The new law appropriates $100 million for child care fee assistance for members of the Army, Air Force, Navy, Marine Corps, and Space Force through September 30, 2029, to improve the quality of life for military personnel.

Historic Cuts to Programs that Serve Children and Families

The Child Tax Credit (CTC)

The CTC previously allowed parents to claim up to $2,000 on their taxes per qualifying child to use for expenses. Some higher-income households will see an increased credit amount to claim (up to $2,200), which is now indexed to inflation. However, the credit was not made fully refundable, failing to reach families with lower incomes who need it the most. The new structure keeps over 19 million children from receiving the full credit and blocks 2.6 million children with U.S. citizenship from receiving any credit at all, meaning millions of families will not actually benefit from this expansion.

Supplemental Nutrition Assistance Program (SNAP)

SNAP, also known as food stamps, provides food benefits to families with low incomes. The new law cuts close to $200 billion of federal funding from SNAP and shifts 75% of administrative costs to states, expands time limits and work requirements, and eliminates eligibility for several categories of lawfully present immigrants. These changes make the program more costly and unstable to implement at the state level, jeopardizing some states’ ability to maintain current levels of services.

Due to the changes in work requirements, approximately 1 in 8 SNAP participants live in households that could face a reduction or loss of their food assistance. This includes about 800,000 children and more than half a million adults aged 65 or older and adults with disabilities. In total, more than 2 million people would be cut from SNAP under the new work requirement provision. Not only does this take food off the table for millions of children and families, it harms the overall economy.

Medicaid

The new law cuts Medicaid by about $1 trillion, which will result in a loss of health insurance for about 11.8 million Americans by 2034. This is the largest funding cut in Medicaid’s history, jeopardizing children’s access to quality, affordable health care coverage.

These cuts are the result of the creation of work requirements, stricter state financing rules, more frequent eligibility checks, and higher copayments. Medicaid is already restricted to people who hold certain immigration statuses, but the new law further restricts immigrant eligibility, which will affect asylees, refugees, and victims of domestic violence and human trafficking. The law discourages more states from expanding Medicaid by eliminating the 2 year extra 5 percentage point federal matching rate incentive. In the coming months, we can expect states to face budget deficits that they need to close as a result of these changes. The biggest impacts will be felt by the 40 states plus Washington, D.C. that have already expanded Medicaid to adults with low incomes, including many parents.

Additionally, nearly 28 percent of child care workers are covered by Medicaid. At least 13 states cover more than one-third of the child care workforce through Medicaid, making the program an essential part of ensuring the health and well-being of child care professionals.

Conclusion

While the new law expands child care tax credits to help make care more affordable for more working families with young children, these improvements are overshadowed by the harm it inflicts on the nation's lowest income families. We know that for child care advocates, the shifts that will happen in state budgets over the next few years as a result of this law are also concerning and potentially threaten the stability of state child care funding.

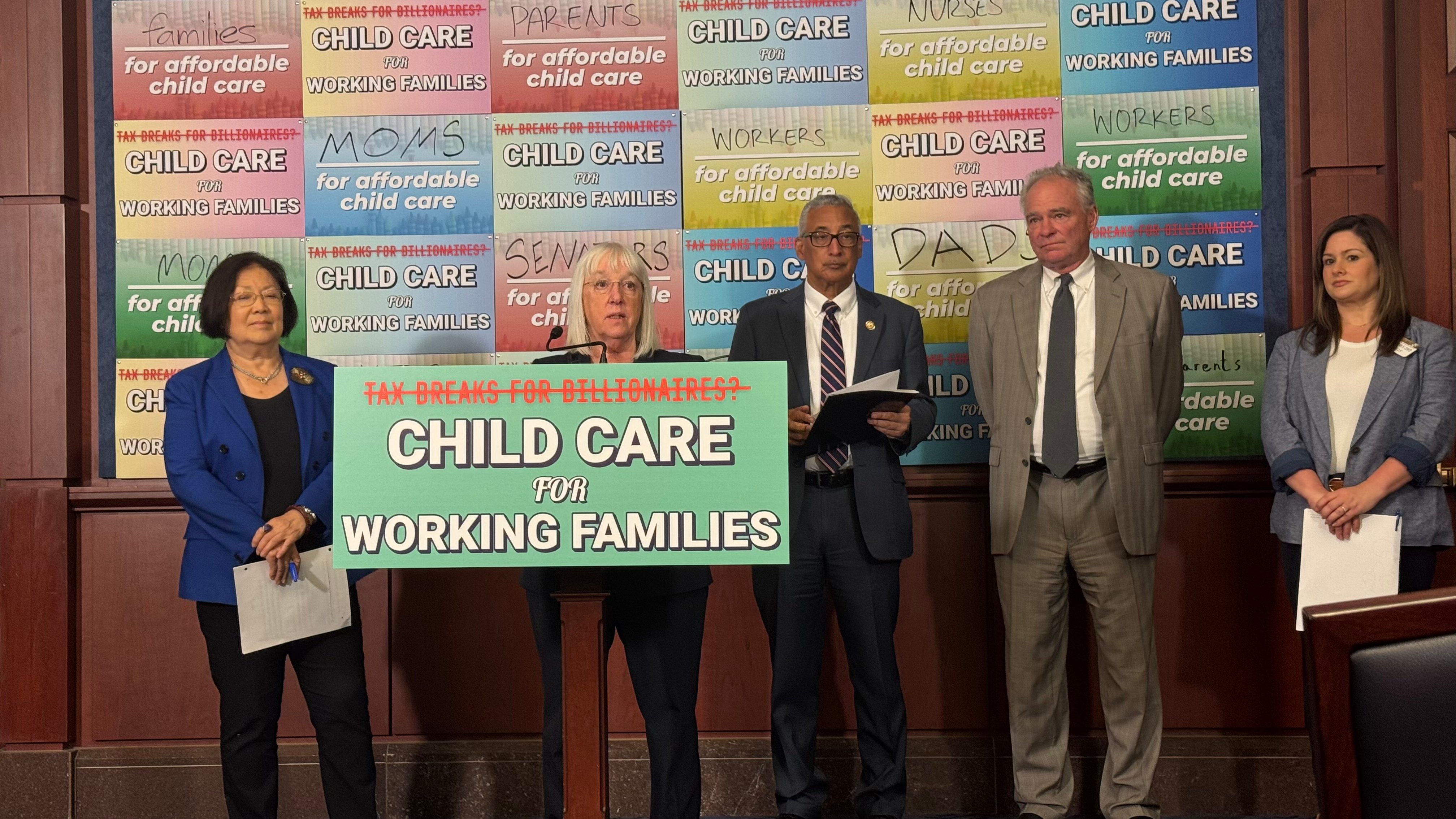

CCAoA's Engagement Along the Way

This May, CCAoA hosted its annual Symposium in Arlington, Virginia, which included an Advocacy Day. More than 300 advocates traveled to Capitol Hill to make their voices heard on these issues, resulting in over 170 meetings with federal lawmakers. These meetings were largely focused on this reconciliation process, including ensuring that the CDCTC was expanded. We are pleased that this advocacy paid off with enhancements to the CDCTC making it into the final law.

Additionally, since January, CCAoA has seen 6,547 actions taken by advocates who contacted their Member of Congress about the CDCTC through CCAoA’s Action Center.

CCAoA issued a statement on the House passage of the budget reconciliation bill calling out the missed opportunity to bolster critical support for working families and a social post in response to the Senate’s draft bill acknowledging the inclusion of an expanded CDCTC while calling for the cuts to SNAP and Medicaid to be reversed.

Over the coming weeks and months, CCAoA will continue to learn more about the implementation of this law and the effects it will have on states and communities.